If you are a regulated business, Finch Global can help you create value from your existing KYC assets – whilst reducing your KYC and onboarding costs.

The Finch Digital Passport, chaperoned by you, enables the holder to validate their identity to any regulated institution instantly and cost effectively.

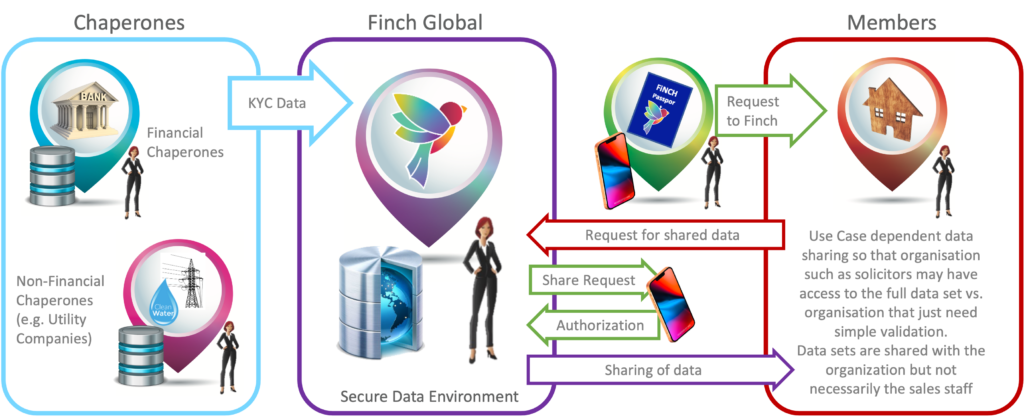

Finch Global converts your customer’s KYC information into a Finch Digital Passport. By providing this information, you become a Finch Digital Chaperone for that respective passport.

Each time a customer uses their Finch Digital Passport at a Finch Member, you, as their Digital Chaperone, will receive a fee.

Beyond opening up a new revenue stream for your business, Finch Digital Passport allows you to offer a new value-added service to your customers. In addition, if you are a financial institution or a credit union, Finch Global provides you with a deeper data pool on members, including information on financial services and obligations taken.

The crucial element of Finch’s value creation model is that it leaves the ownership and control of customer data in the hands of the original data controller (i.e. the Finch Digital Chaperone) – this data will only be used for purposes allowed for by the data owner or passport holder. Finch does not underwrite or remove liability from regulated businesses (Digital Chaperones and Finch Members).

The unique value of Finch is the secure information exchange: it facilitates the gathering, maintenance and validation of data needed by a regulated service provider to make their own onboarding decision.

Finch is powered by Heliocor’s Dokstor award-winning technology, creating a secure environment for the whole ecosystem.

Heliocor is one the most innovative Regulatory Technology ‘RegTech’ companies in the UK, specialising in providing cutting-edge risk, compliance and behavioural (fraud) monitoring software solution to banks and financial institutions globally.

“Better digital identification will be essential for households and firms to benefit from the digital economy. The high cost of identification means finance is expensive and underserved…considering how central identification is to accessing finance...[there is a need to be a] champion of better trusted digital identification where the UK has lagged.”

Huw van Steenis,

Senior Advisor to the Governor of the Bank of England